Will copper continue to rise?

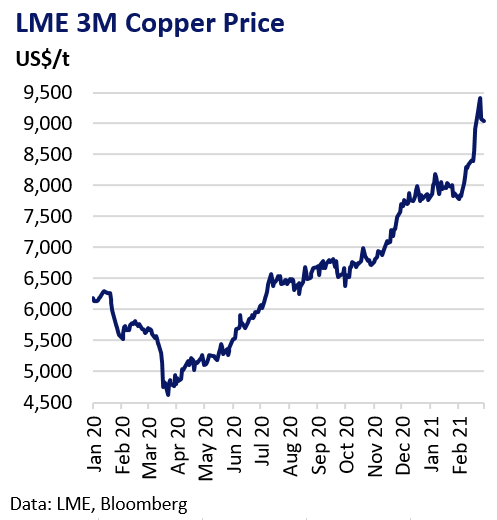

Copper’s relentless rally from March 2020 lows has seen prices rise by almost 50% from pre-pandemic levels to almost $9,500. The rally accelerated in February amid bullish forecasts from banks including Goldman Sachs, who expect prices to hit record highs of $10,500 within the next 12-months. Deficit expectations, low visible inventories, long-term demand hopes and record global stimulus support are key bullish drivers. While the copper outlook looks overwhelmingly rosy, it is prudent to recognise the risks threatening a continuation of the bull market trend.

Demand Expectations

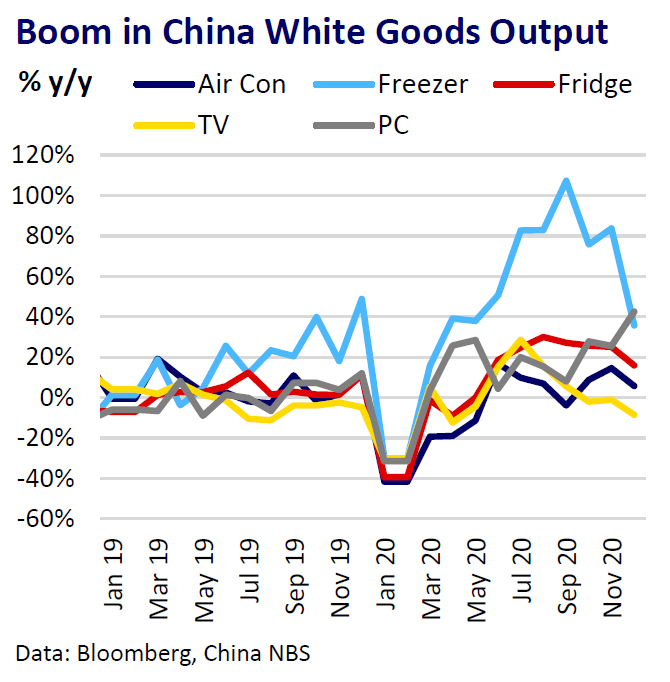

Strong demand for consumer appliances and China infrastructure investment drove copper consumption in 2020. Similar trends outside China are the basis for expected demand growth of ~5% in 2021 from industry analysts as key economies recover from Covid lockdowns. Strong China copper premiums support a view of robust demand in the near-term. Bulls also cite long-term demand growth prospects from decarbonisation trends such as electric vehicle charging infrastructure and 5G networks. One risk is that demand for appliances will fade as easing virus lockdowns sees global consumer spending shift back from goods to services. It may also be years before the expected impact of the decarbonisation narrative for copper demand is realised.

Supply Rebound To Lag Demand

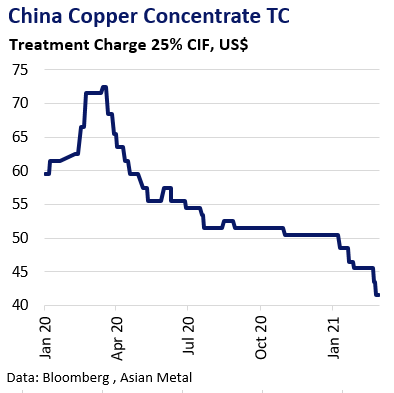

Analysts are generally looking at supply growth of 2-3% in 2021, lagging demand. Analysts expect ongoing pandemic disruption and delayed investments will hamper mine supply growth. Low China treatment charges are reflective of global concentrate market tightness, with leading China smelters facing cuts to output as a result. However, a wave of seaborne shipments of concentrate is due to arrive in the coming months and could ease pressure on TCs. Peru is anticipating 21% growth in copper output in 2021 as production normalises, signalling no major impact from the ongoing pandemic. Scrap supply is likely to improve with prices near decade highs.

Market Balance and Stocks

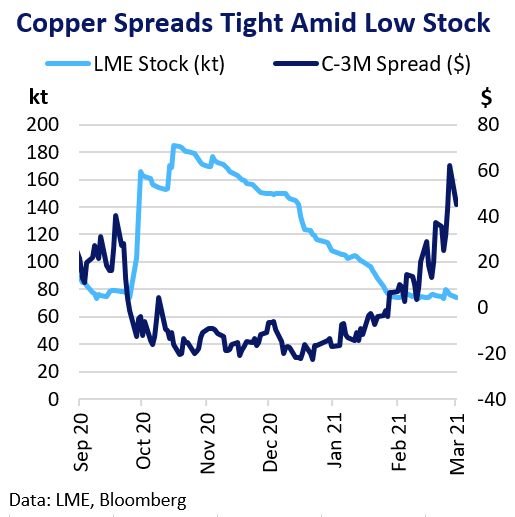

A broad consensus among industry analysts is that the copper market will return to deficit in 2021, or at least by the second half of the year. Published surplus estimates vary from ~400kt to ~650kt. Bulls will point to low LME copper inventories and tighter spreads as a sign of supply shortage fears. Hidden copper stocks in locations such as Rotterdam could limit spread tightness. Deficit projects are subject to uncertainties around supply and demand outlined above.

Rally Vulnerable to Tapering Risks

Easy monetary conditions and fiscal policy support continue to underpin relentless speculative risk-appetite and physical end-use demand. Dollar weakness and demand for commodities as a hedge against an anticipated rise in inflation are also copper supportive. Central Banks and governments are clear they will maintain accommodative policy in 2021 to support the recovery. However, risk assets including copper remain vulnerable to any shift in policy expectations towards tapering. Policy tightening in China is a more immediate risk as it looks to rein in credit conditions and a red hot property market.

Conclusion

The outlook for copper is understandably bullish, with strong macro and fundamental drivers. But with prices and speculative positioning at elevated levels, a continuing rally will be increasingly vulnerable to shifts in current expectations for continued stimulus, strong consumption growth and a restrained recovery in mine supply in 2021.