How Will Ukraine Tensions Impact Base Metal prices?

The threat of a Russian invasion of Ukraine has stoked geopolitical tensions between Russia, the US and its European allies. A military incursion and subsequent retaliatory sanctions could affect base metals markets via disruption to Russia’s metal supply, higher energy costs for Europe’s metal producers and macro-led risk-reduction.

Background

Russia has amassed a sizeable military force along its border with Ukraine. The US and its European allies fear an invasion this February and are threatening Russia with serious economic and financial sanctions if it proceeds.

Measures could include cutting Russia off from the SWIFT global payment system, restricting access to the US dollar, and blocking the approval of the Nord Stream 2 pipeline.

The threshold for sanctions for action short of a full military invasion is unclear, as is the exact detail and timing of potential sanctions.

European nations worry about the impact on their own economies, which could temper measures. All sides remain in dialogue, with Russia focussing on concerns about NATO expansion, but tensions remain elevated.

Could Sanctions Hit Metal Supply

Disruption to Russian metal supply would support base metals prices and physical premia.

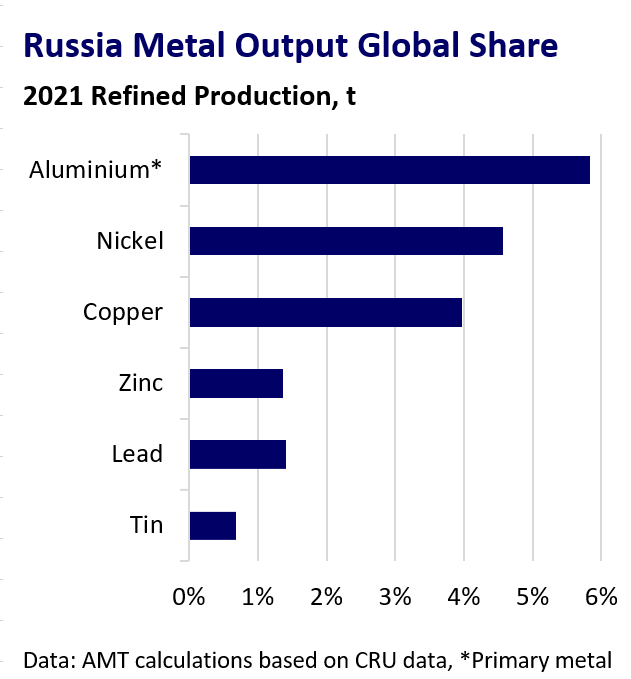

Russia’s global production share of aluminium, nickel and copper stand out among the rest of the base metals.

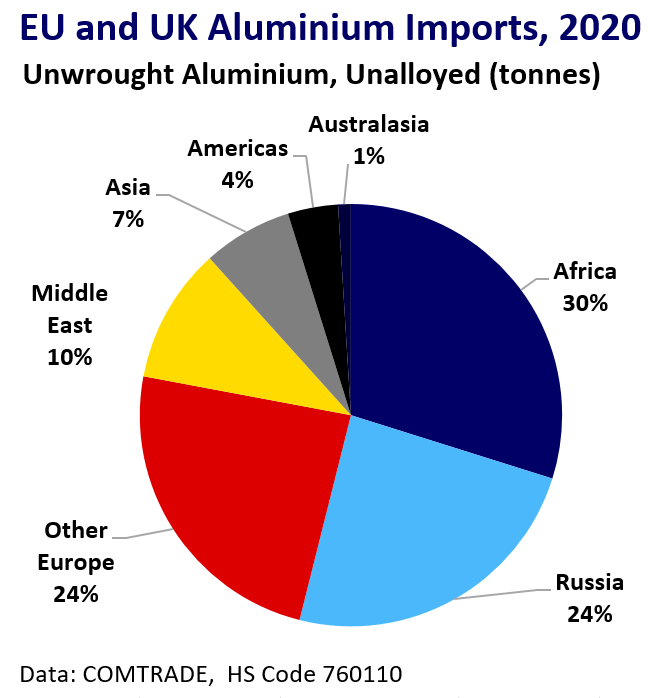

Russian exports to Europe are also at risk. For aluminium, in 2020, 17% of the EU and UK’s primary metal imports were from Russia. The share rose to 24% with alloy included.

It is unlikely that sanctions would directly target Russia’s metal trade as Europe struggles with tight metal markets and scarce inventories.

Sanctions on Rusal and En+ in 2018 hit European consumers hard and policymakers will be wary of repeating this approach.

Complete disruption to Russia’s metal flow is therefore unlikely, but reduced trade is a predictable consequence if financial sanctions hit state-linked producers.

Energy Vulnerability

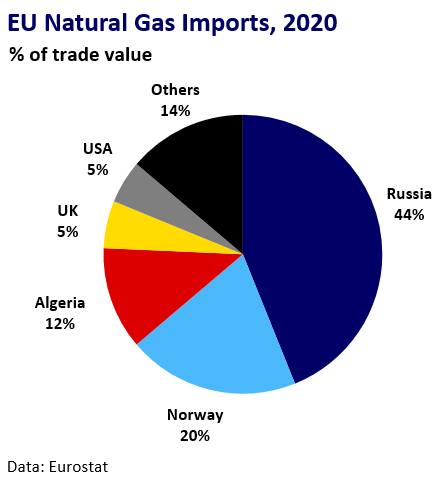

Russia could look to exploit European dependence on its natural gas supply in retaliation for sanctions.

Russia’s state-owned gas suppliers are already restricting exports, perceived as leverage for accelerating approval of the Nord Stream 2 pipeline.

Gazprom’s aggregate gas flows from Russia and Belarus to Ukraine and the EU fell 11% q/q and 27% y/y in Q4 2021.

The EU depends on imports for ~80% of its natural gas consumption. 44% of EU natural gas imports by value came from Russia in 2020.

Europe also relies on natural gas for ~20% of its electricity needs. High electricity prices have already hit European zinc and aluminium output this winter.

Surging natural gas and energy prices may trigger further output cuts, driving prices higher. It may also add to broader inflationary pressures threatening growth.

Financial Market Pressure

Macro-led risk-reduction in financial markets in response to a military escalation is a more indirect downside risk.

Russian and European equity markets would likely suffer most, but metals may encounter selling pressure as macro-led investors cut risk exposure and dollar strength weighs on commodities.

Copper is most exposed due to its macro-proxy characteristics.

Conclusions

A full Russian military invasion of Ukraine is not the base case, with lower-level hybrid warfare or a limited incursion more likely. However, if it occurs, it would likely be positive for base metals overall, as supply of Russian metal and natural gas will likely be threatened.

The net impact of tin and lead may be marginally negative, with supply at limited risk and pressure from broader financial risk-aversion and dollar strength.

Aluminium appears most exposed, vulnerable to disrupted Russian exports and fresh energy-related supply-cuts in Europe.

Global markets are already pricing in some of this risk, so a de-escalation of tensions may have the reverse effect.