How Is Demand for Pipeline and Strategic Metal Inventories Likely to Change?

Base metal availability and pricing remain sensitive to trends in supply-chain inventory requirements amid global shipping disruption. A bullwhip effect may be playing out in the global goods sector. This could weigh on prices if global freight issues ease during 2022. Growing barriers and risks to international metals trade may drive governments to develop or expand strategic inventories. This is a long-term upside risk for prices.

Shipping Delays Tie Up Inventories

There are ongoing delays to global shipping due to Covid-related port congestion and container shortages. This implies growth in “in-transit” metal inventory proportional to delays in shipping times.

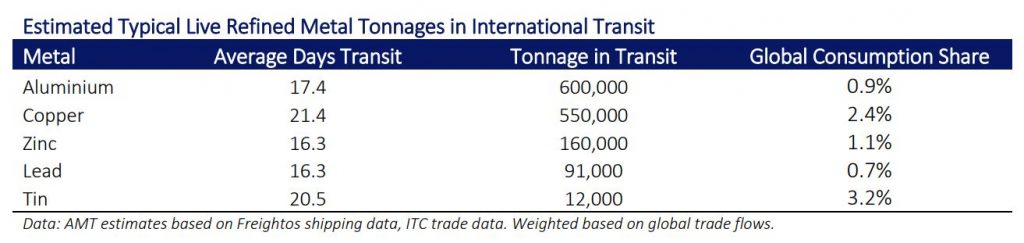

In the table below, we provide rough estimates of the typical live tonnages of refined metal in international transit. The volumes relative to global consumption vary by metal. The market impact of demand for extra in-transit metal inventory may be limited.

However, consider that there has likely been growth in in-transit inventory for all traded goods due to shipping delays. The compounded impact of this pipeline inventory growth from raw materials through to finished goods is likely significant.

The eventual easing of shipping disruption could free up this excess inventory, increasing goods availability at each stage of the supply chain.

Beware the Bullwhip Effect

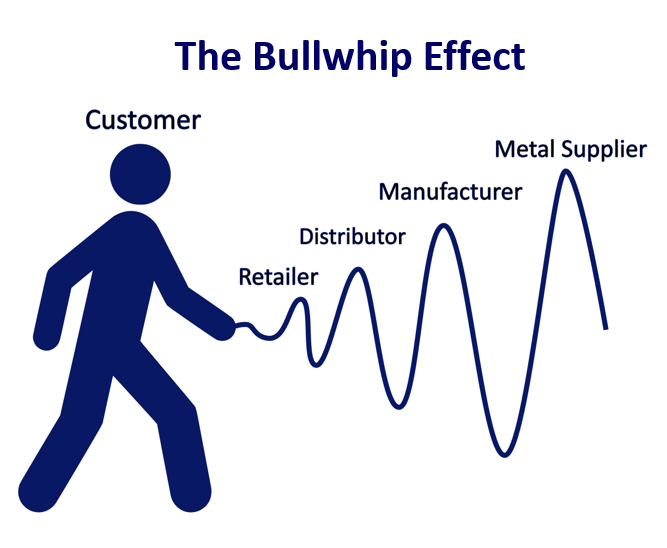

Retailers and manufacturers are concerned by tight goods availability and unreliable shipping. This may be driving over-ordering that has reverberated up the supply chain. This is known as the bullwhip effect and may be exaggerating underlying demand strength and exacerbating pressures on shipping.

Inventory management has switched from “just-in-time” to “just-in-case”, particularly for larger companies with the cash flow to employ such an approach.

The risk is that as supply-chain dislocations ease market shortages quickly turn to surpluses and excess inventory. This will occur if end-user demand ultimately proves softer than strong order books imply. However, pent-up consumer demand supported by excess household savings remains a strong argument for sustained strong goods consumption. This could outweigh and outlast any easing bullwhip effect.

When will Supply-Chain Issues Ease?

An idea of when supply-chain bottlenecks could ease is as important as understanding the possible impact when they do.

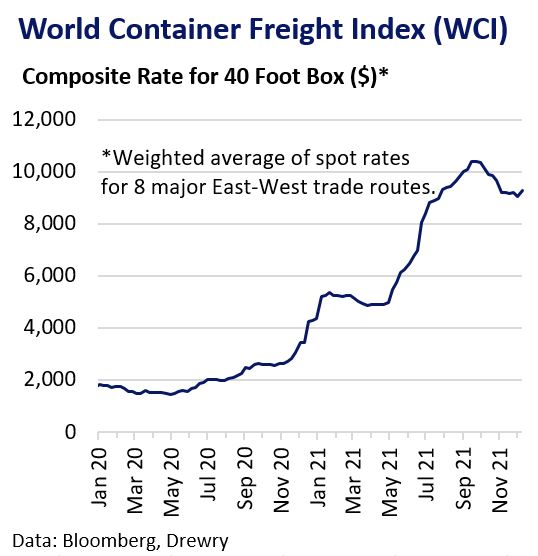

Container-shipping rates have eased slightly from September highs. However, global shipping congestion is likely to remain elevated in the coming months.

The Head of the Port of Los Angeles expects supply-chain congestion to peak ahead of China’s New Year holidays in February. Even then it could take until at least the end of 2022 to normalise.

Semi-conductor shortages are also set to persist; Bloomberg reported that order lead times rose to 22.3 weeks in November. This was four days more than in October.

Role of Strategic Stockpiles

A long-term inventory consideration is how governments will respond to rising geopolitical tension, resource nationalism and global competition for resources. There is also a growing appreciation of the crucial role key metals will play in the green-energy transition and in critical national infrastructure projects.

Strategic government stockpiling of metal is one possible measure that could be developed or expanded. If European countries or the US opted for such a programme as policies around critical minerals develop, it could prove highly price-supportive.