Zinc Price Outlook – Strong Fundamentals Meet Macro-Pressures

After two years of stimulus-fuelled gains, zinc prices are off highs as global growth headwinds threaten the zinc demand outlook and broader risk appetite. However, ex-China inventory scarcity, European smelter curbs due to high energy prices, and significant global deficit projections for 2022 should help zinc weather the macro-storm.

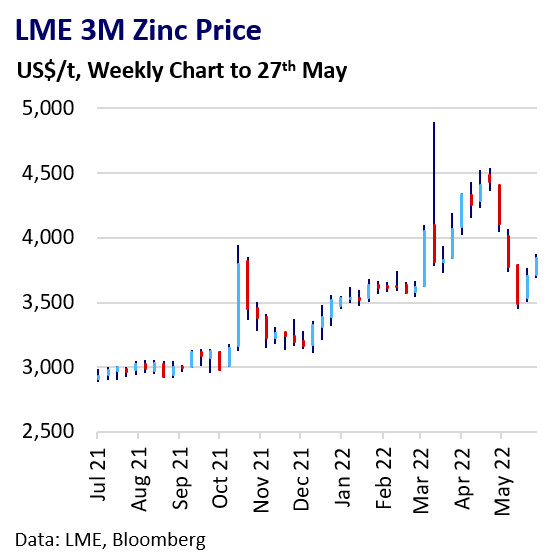

Price Review

Alongside its base metal peers, the LME zinc price came under heavy selling pressure in late April and early May. Investors dumped risk assets amid mounting risks to global growth from China’s Covid lockdowns, Fed monetary policy tightening, and soaring inflation.

Zinc retreated 24% from its April high to May low. However, zinc subsequently pared losses after finding support at the 200-dma. The 3-month price remains well above the $2,280 average of the last decade (2010-2020). Funds with a shorter-term view liquidated their net long position, but longer-term funds retain bullish zinc positioning overall.

While the macro-backdrop has deteriorated the market is still fundamentally tight and inventory constrained.

Consumption

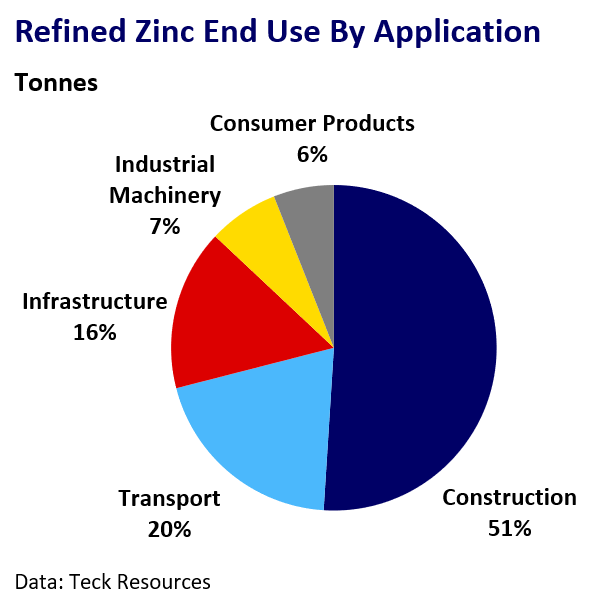

Market observers expect a zinc demand slowdown this year after the stimulus-fuelled gains of 2020 and 2021. The ILZSG sees demand growth falling to 1.6% from 5.7% last year, with use in China rising 1.0% vs 1.5% in 2021.

Physical demand remains robust in the US and Europe, where strong construction activity has negated automotive sector weakness. Car producers continue to struggle with component shortages, exacerbated by the conflict in Ukraine.

However, tighter monetary policy and the rising cost of living due to high inflation risk undermining economic activity in H2 and into 2023.

China’s Covid lockdowns have severely hit domestic demand and its zero-Covid approach may persist as a threat to growth. The consensus is China will now fail to hit its 5.5% 2022 GDP target.

However, domestic zinc consumption could recover gradually as Covid measures ease and policymakers boost economic support.

The infrastructure sector is the most likely vehicle for a stimulus-supported Chinese demand rebound, but we are yet to see concrete policies that could deliver a meaningful consumption boost.

Mine Supply

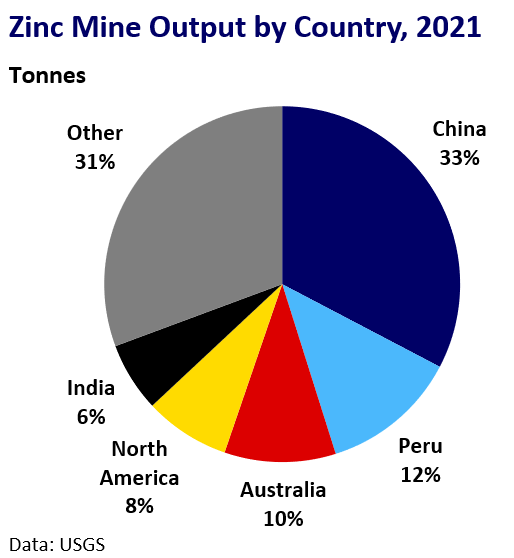

Global zinc mine output is likely to slow in 2022. Neves Corvo is ramping up output after undertaking an expansion.

Headwinds to growth include flooding at the 70 kpta Perkoa mine in Burkina Faso, the impending closure of Hudbay’s 45 ktpa 777 mine in Canada, and mine disruption risks from heightened social unrest in Peru.

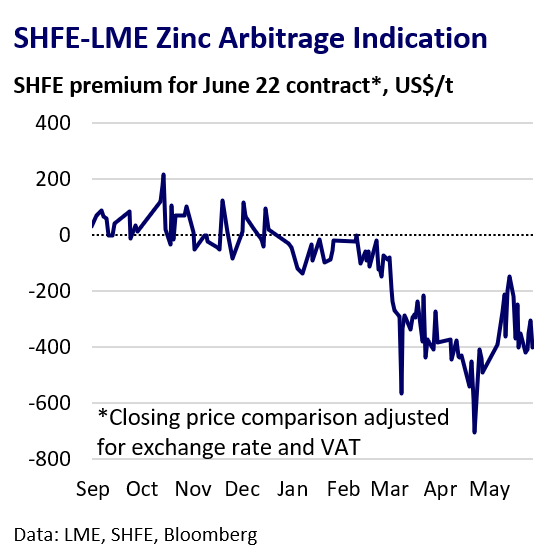

Ex-China concentrate availability has much improved amid smelter output constraints and reduced China import demand due to the current LME premium to SHFE.

China’s domestic market for ore is tight due to reduced imports and lower seasonal winter domestic production in Q1. The ILZSG sees China’s mine supply rising 2.3% in 2022.

Refined Supply

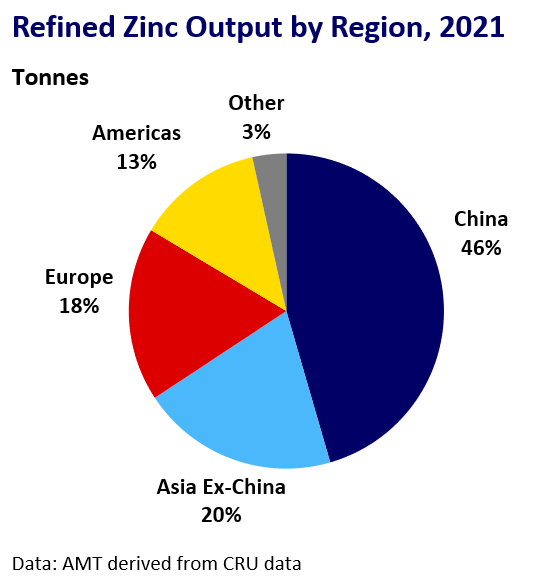

Active smelter capacity is currently a greater bottleneck for global zinc supply than mine output and will constrain output growth in 2022. The ILZSG forecasts a modest 0.9% rise, with China mostly driving gains.

European zinc smelter output disruption due to elevated energy prices remains the main constraint on output growth. Production from Canada and Peru may also decline.

The refined zinc outlook remains sensitive to European energy market developments. Higher energy prices could further choke supply.

Market Balance & Inventories

The ILZSG sees a 292 kt global zinc market deficit in 2022, equivalent to 2.1% of global consumption, although global demand headwinds may see this narrow.

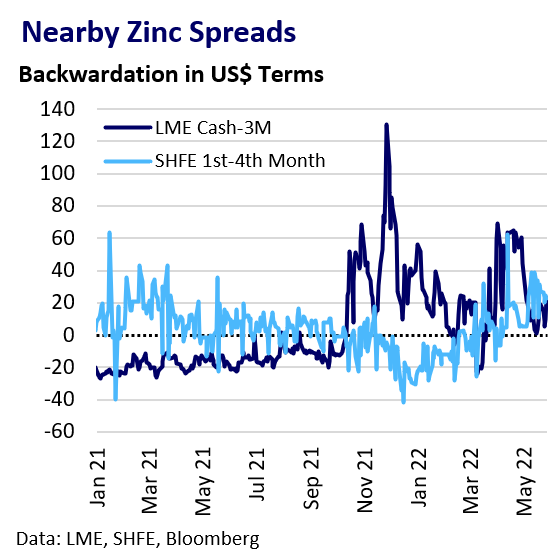

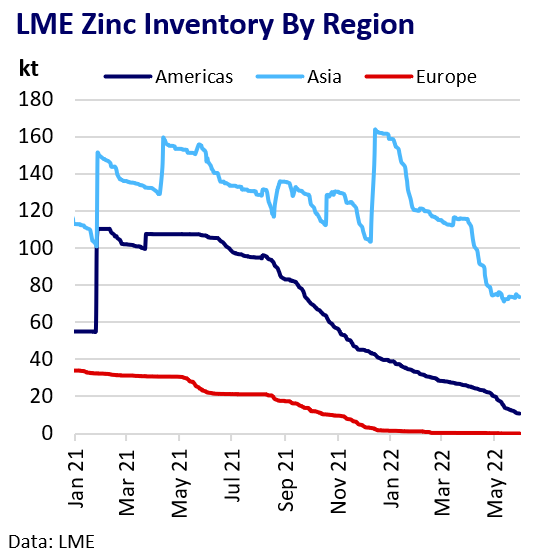

Inventory availability shows regional divergence. Visible ex-China inventories are under acute pressure. On-warrant inventories are hovering near record lows.

Regional shortages of inventory have persisted, with effectively no available LME stock outside of Asia. Surging US and European physical premiums reflect these shortages.

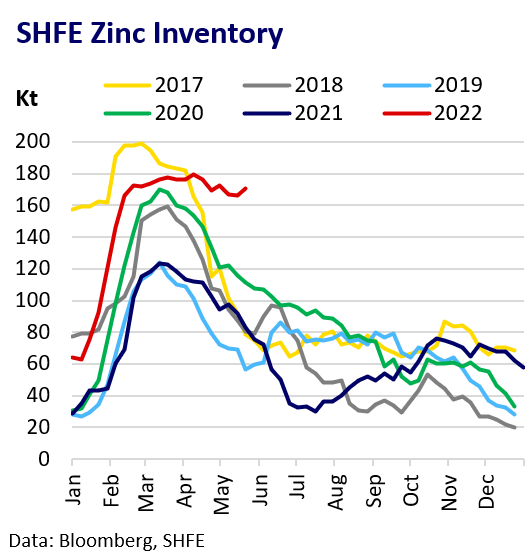

SHFE zinc inventory is well above seasonal norms. Q2 destocking is slower than in recent years as Covid has hit domestic demand.

Outlook

Zinc is swimming against a tide of global growth risks, but we think physically tight ex-China markets, low and unbalanced global inventories and a potential China demand rebound could partially insulate zinc in the event of a global economic slowdown over the remainder of 2022.