Will tin bounce back or continue to drop?

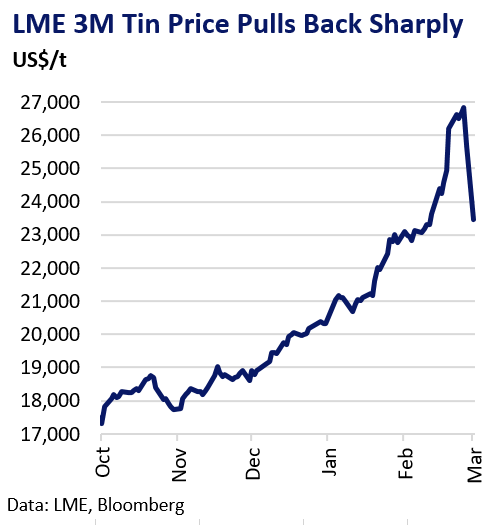

The LME 3-Month tin price gained up to 35% in early 2021 amid unprecedented global physical supply tightness. Nearby spreads hit extreme backwardations amid low global inventories. However, prices eased sharply in recent days amid aggressive selling; Investors fear an easing of metal shortages in the coming months, with LME inventories rising from lows. Prices may come under renewed pressure as the year progresses amid rebounding output from key suppliers and an uncertain demand outlook. Physical market tightness is likely to persist in the coming weeks, providing short-term support, particularly after the sharp recent correction. A bullish macro-environment also provides underlying support.

Drivers of Recent Supply Tightness

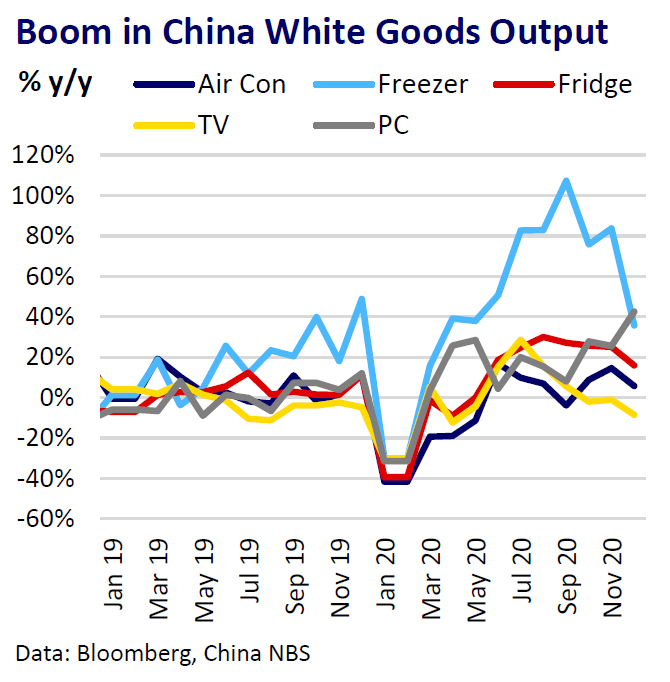

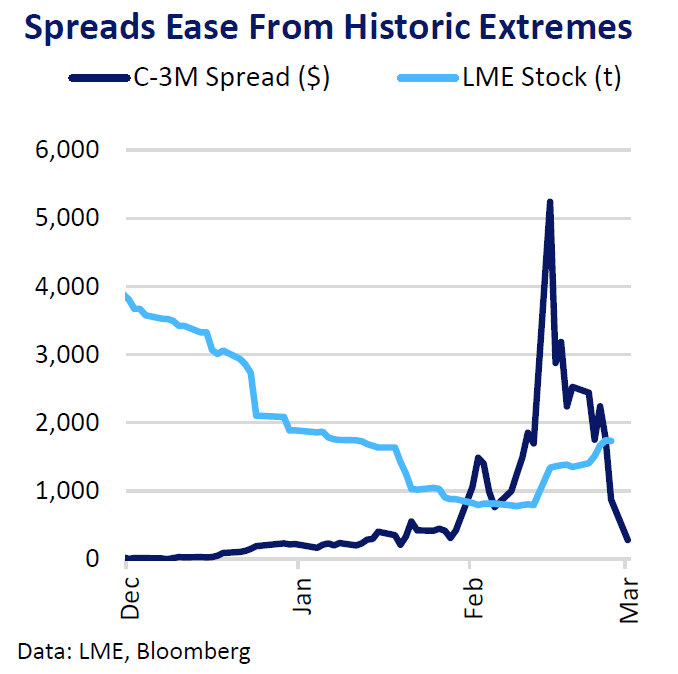

The physical tin market experienced a perfect storm of bullish factors in early 2021. Tin consumption surged as pandemic lockdown restrictions and fiscal policy support for incomes supercharged consumer demand for household and electronic goods. A mixture of pandemic restrictions and adverse weather conditions disrupted mine supply throughout 2020 and early 2021, particularly in Indonesia, Myanmar and South America. A low global stock environment exacerbated the price reaction to the market imbalance. LME spreads hit extremes of $6,500 and the 3-month price peaked at $27,500, the highest in almost a decade. A weaker dollar and broad demand for metals as an inflation-hedge also proved supportive.

Prices Not Sustainable Long-Term

Event-driven tightness in the physical market is unlikely to be sustained longer-term as conditions normalise. Strong consumer electronics demand likely brought forward tin consumption during the pandemic. A broad recovery from government-imposed lockdowns later this year is likely to see a shift of consumer spending away from goods and back to services. Indonesia and Myanmar mining output is likely to recover from wet-season weather disruption by April. South American producers are unlikely to see pandemic restrictions and business disputes impact output to the same extent as 2020. Higher prices will help accelerate a rebound from marginal sources such as small-scale mining operations.

Macro-Drivers

Even if prices retreat further this year as tin’s fundamentals normalise, we are unlikely to see a sustained return to prices below $20,000. The US dollar remains weak and markets believe in a continuation of accommodative monetary and fiscal policy. Rebounding energy prices also mean higher input costs for producers and a higher marginal cost of production.

Summary and Outlook

The tin market remains physically tight, which could continue to bolster prices in the short-term. However, market participants may look to increasingly price in an anticipated recovery in output and metal availability from Q2. There remains further downside risk for prices as consumer spending patterns shift away from goods as Covid-19 curbs on movement and service-orientated businesses subside later this year. As long as easy global fiscal and monetary policy persists, a decline in prices below $20,000 appears unlikely, although the spectre of policy tapering in the coming years could hurt tin if it leads to a sharper and more sustained sell-off across risk-assets.