3 December 2024: Zinc prices have rallied this year, despite a backdrop of lacklustre demand conditions in the Chinese property market. Recent days have also seen a sharp fall in on-warrant LME stocks, with cancelled warrants jumping, which is helping to create tightness on the exchange. The physical market is also tight, with spot treatment charges falling into negative territory, due to a lack of mine supply. The outlook will depend to a large extent on progress with three key mines in Africa, China and Russia, which all face their own unique challenges. On balance, we expect zinc prices to remain range-bound in the months ahead, favouring mean-reverting models over trend following.

Zinc outperforms copper and aluminium. So far this year, 3-month LME prices for zinc have significantly outperformed copper, despite a backdrop of lacklustre activity in Chinese construction markets – a key area for consumption. The zinc price is up 16% YTD, whereas copper is up a modest 5% and aluminium is up 9% (data to 2 December). Zinc is also the only market to see tightness in terms of LME spreads, with the cash-to-three month spread currently in a US$6/t backwardation.

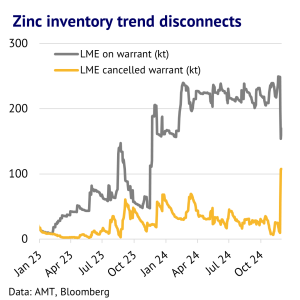

Available LME stocks now low, with cancelled warrant spiking. One reason for the immediate tightness is that one of the major international trading firms is rumoured to be shifting metal out of LME warehouses to less visible locations. On-warrant LME stocks are down 79kt in the past week (data to 2 December) – see chart. The main reason is that a large amount of the metal-in-warehouse is booked to leave, with cancelled warrants up 97kt w/w to 197kt. The LME is now flagging up that one entity owns 50-79% of remaining warrants, which suggests that it will be difficult for other market participants to access what remains.

Fundamentals are also tight, but LME signals may be misleading. Given this background, it is tempting to assume that zinc prices will also be pushed higher in the weeks ahead. However, it is worth noting that the market often sees periods of backwardation, but these tend to be brief. Furthermore, LME stock data (for both on-warrant and cancelled warrants) are very volatile and may be giving misleading smoke signals – see chart above. More important for the medium-term direction of prices, is the underlying trend in market fundamentals, which often follows its own dynamic.

Very low treatment charges are driving supply-side tightness. One thing that is clear in the world of fundamentals is that miners are not producing enough concentrate to meet downstream demand from smelters. This has been reflected in spot treatment charges, which fell to around US$-35/t on 30 August cif China, according to Fastmarkets, and has moved little since then.

Three mines will help determine the outlook. Looking ahead, areas of uncertainty include three key mines that are coming onstream: Kipushi (DRC), Huoshaoyun (China) and Ozernoye (Russia). Eventually these three could produce 1.08Mt of contained zinc at design capacity, making them an important swing factor in a 13Mt/y market. However, they all have their unique challenges, including power supply problems (Kipushi), recent fire damage (Ozernoye) and a remote location (Huoshaoyun), subject to extreme weather conditions.

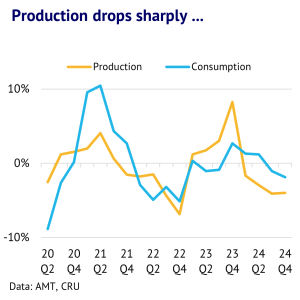

Smelters and miners need to find common ground between spot and contract. There is currently a significant difference between global contract treatment charges (TCs) – settled at US$165/t for 2024 deliveries – and spot prices. This will make negotiations about contract terms for 2025 deliveries particularly interesting to follow, as smelters and miners make their best guess about how long market tightness will last. CRU recently highlighted that expected growth in zinc mine production for 2025 ranges from 0.3Mt to 1Mt. Looking further downstream, the consultancy firm predicts that metal production will fall 8% this quarter – see chart below – confirming that many smelters are being forced to retrench. The most recent SMM survey shows that China is driving a lot of this, with production in November expected to be down 6% y/y, after a 15% y/y drop in October, and SHFE stocks have been trending lower.

LME speculation is mid-range and prices are likely to remain range-bound. In terms of LME net speculative positions there is potential for growth from here in the futures market. Looking at the most recent data, net speculation in the week ending 22 November, stood at 53% of the historical five-year range. Furthermore, speculative longs are currently 77k contracts, down 42% from its most recent peak back in May 2021. On balance though, zinc prices now look close to fair value and are likely to remain range-bound in the months ahead, in the range US$2,500-3,500/t. Weak demand is likely to remain a headwind, but risks to mine supply also look elevated.