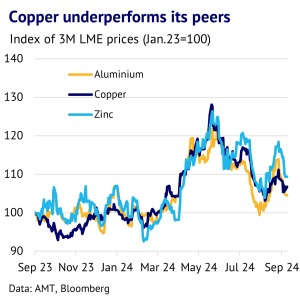

11 September 2024: LME three-month copper prices rallied into mid-May, but have fallen significantly since then. The biggest problem for bulls is that the Chinese economy continues to struggle, and demand is not growing as quickly as expected. Another challenge is that mine supply growth has picked up in Chile and the DRC is booming, allowing smelters to grow once more. Even though the copper market looks moderately oversupplied, the fourth quarter of the year normally sees prices rally for seasonal reasons and we believe that risks are now skewed to the upside.

Three-month prices drop, as bulls become more cautious. Back in May, bulls anticipated a looming market deficit and believed that stimulus measures in China would work their magic once more. However, fast forward four months and Chinese consumers are still looking depressed, and this has finally fed back into downgraded views for copper and the economy more broadly. LME three-month copper prices are down 17% from their mid-May peak (data to 9 September). The problem for bulls has been that inventories have been building and investors are nervous about weak manufacturing activity in China. Confirmation of this comes from our most recent analysis of LME COTR positions, which shows that speculative long liquidation was seen throughout August. The latest report can be found here: https://amt.co.uk/amt-lme-cotr-analysis/.

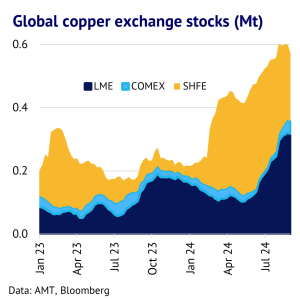

Exchange stocks are up this year. One obvious sign of market oversupply is that exchange stocks (LME, COMEX and SHFE) have been building across many parts of the world. At the start of this year, these stood at 217kt, but by the end of August they had nearly tripled to 603kt – their highest level since early 2020. While this still only represents 9 days of global consumption, it is flagging up a soft physical market.

Big contango encouraged cash-and-carry. There is also the potential though for cash-and-carry traders to be distorting this recent trend. A deep contango emerged back in early July, with the LME cash-to-three-month contango briefly reaching US$161/t, or a potentially attractive yield of 7% (annualised). Given this, some metal in LME warehouses was probably diverted into financing deals and might now be tightly held. When fundamentals next start to tighten, the real availability of metal will then become known and until then we would warn against excessive bearishness.

Copper prices often perform well in Q4. It is also worth noting that seasonality trends are starting to favour being bullish. While September is often a weak month for three-month prices, the average increase in the fourth quarter over the past 15 years was 6.6%. Copper demand normally peaks in Q2, but prices tend to follow a different trend, which is more aligned with global equity markets. The S&P500 index, for example, often rallies in November (its second-best month of the year) and the average increase in Q4 over the past 15 years was 6.1%. This implies that investor flows often dominate price action, but also of course that markets tend to be forward looking and move ahead of the physical stocking cycle.

China hits a soft patch in Q2, but some signs of improvement in July and August. Chinese demand has been underperforming expectations this year, due to a combination of high copper prices and underlying weakness in the economy. At this point it is difficult to easily separate out these two drivers, but we believe that lower prices will encourage demand once more as we head into the end of the year.

Looking at sectors related to electricity & electronics (including electric vehicles) shows that average growth was still running at a robust 16% y/y in July. However, the data for August showed mixed trends for copper fabricators. Copper tube makers cut utilisation rates into the end of the month (partly for seasonal reasons), while wirerod makers saw a modest improvement from mid-July to end-August. Despite this, figures from CRU show decent growth in copper consuming sectors, outside construction, and they are still forecasting 5% demand growth for this year. Furthermore, high frequency data on traffic congestion in China supports the idea that the economy improved in late August and early September.

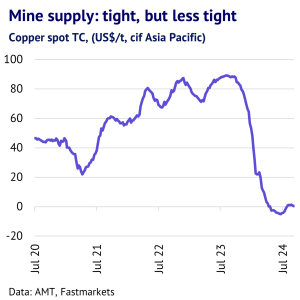

Mine supply still remains tight. On the supply side of the industry, the concentrate market still looks relatively tight, but more concentrate is getting through to smelters. According to Fastmarkets, spot market activity was quiet in August, but spot prices for delivery to Asia Pacific were close to zero at the end of the month, up a few dollars from a month earlier.

Moreover, global mine supply looks set to grow this year. The most recent figures from Chile show that copper output increased by 2.5% y/y in the first seven months of this year, as this key mining country recovered form a 1.5% fall in 2023. The DRC is also ramping up production, with its giant Kamoa mine coming online more quickly than previously anticipated. The Phase 3 concentrator came online in June, rather than Q4. Output is set to increase to more than 600kt/y of copper. On the smelter side of the industry, Chinese plants reduced output by 2.4% m/m in August, according to figures from Shanghai Metal Market. Further modest cuts are expected in September. However, global smelter output will probably increase by around 3% this year.

Market is oversupplied, but only modestly. The global copper market was moderately oversupplied in the period Q1-Q3, but fundamentals often tighten in Q4, as demand gathers momentum before the end of the year. We expect this to mean that investor flows will be able to push copper prices higher once more in Q4, even if fundamentals themselves remain lacklustre. The AMT algo model currently has a sell signal, which gives us some reason for caution, but we believe that any weakness will be short-lived, given the broader picture for speculative flows and fundamentals.