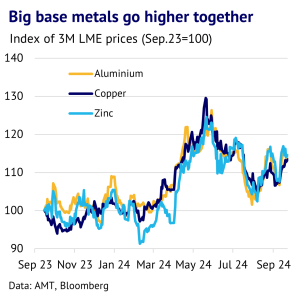

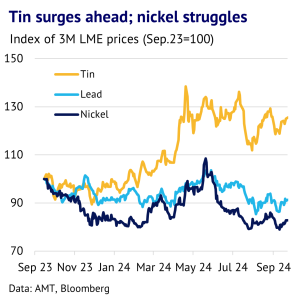

24 September 2024: The LME base metals complex saw mixed price trends in the past year, with aluminium, copper and zinc all up, while tin prices soared. The OECD countries saw sharp falls in inflation and US interest rates were cut, helping to boost financial markets and commodities more generally. Speculative positions have increased for many of the base metals, although fundamentals have also been supportive and demand in China is showing pockets of surprising strength. Furthermore, all the base metals, apart from nickel, are seeing a squeeze on raw materials, due to a lack of investment and resource nationalism. Finally, lead and nickel have followed their own path downwards, showing the continued importance of fundamental drivers, amid the broader bullish backdrop. We expect most base metal markets to rally in the year ahead.

Largest base metal markets rally in the past year, but significant divergence across the complex. The past year has seen the major base metal markets rally significantly, despite a backdrop of mixed economic activity in China. Three-month LME prices for aluminium, copper and zinc are up 11%, 16% and 13%, y/y respectively, although tin has been the star performer of the complex with a 22% y/y increase (data to 23 September). However, weak fundamentals have weighed on both lead and nickel, and prices are down 7% and 15%, y/y, respectively.

AMT price picker competition outperforms again. Interestingly, our price picker competition (conducted during LME Week 2023) was a useful guide to market direction. The median price was expected to trend higher for all the base metals, in contrast to bearish sentiment which prevailed during the London gathering. Aluminium was expected to perform best, while lead was expected to be weakest. However, the survey was too optimistic on nickel, assuming that all the bad news from a fundamental perspective had already been priced in.

AMT price forecast was too conservative. In terms of our own price forecasts, we were not bullish enough on aluminium and tin, even though we predicted higher prices for both. We also expected copper and zinc prices to fall, which did not happen. On lead and nickel, we correctly anticipated lower prices, due to too much investor froth (for lead) and weak fundamentals (for both lead and nickel).

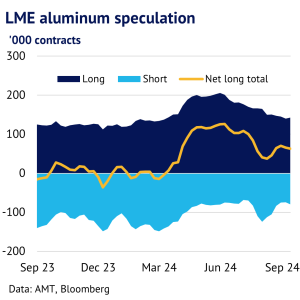

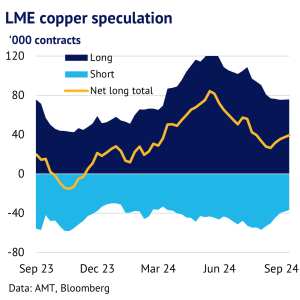

Investor inflows helped to drive up aluminium, copper, tin and zinc. Looking at LME speculative positions (using the AMT definition of Investment Funds plus Other Financial Institutions), our analysis shows that investors played a key role in helping to move markets higher. To illustrate this, we look at how the net speculative position for each market has changed over the past year. For easy comparison, the lowest speculative position in the past 5 years is set to zero and the highest to 100%.

Using this metric, speculation in zinc increased the most, with an increase to 54% of the five-year range (data to 13 September 2024), up from 12% a year ago. This was closely followed by aluminium, copper and tin, where the net speculative position increased by 34%, 32% and 37%, respectively.

Furthermore, for these markets, there is still scope for further growth in the months ahead, if recent cuts in US interest rates encourage extra flows into metals. Current positioning for aluminium, copper and tin stands at 39%, 55% and 67%, respectively, showing that aluminium has the most potential upside, but both copper and tin could easily build from here.

Investor cutbacks helped to drive down lead prices. By contrast, LME speculative positions for lead fell sharply in the past year, helping to push down prices, amid weak fundamentals. The market looked overbought back in September 2023, with net speculative positions at 100% of the historical range. This has now been cut back to just 9%.

Finally on nickel, positions have hardly changed. These edged up to 7% of the five-year range, compared to 1% back in September 2023. This suggests that the fall in nickel prices was mainly driven by weak fundamentals, rather than investor flows. Our most recent LME COTR analysis is on our website here: AMT LME COTR report. Historical reports are available on request.

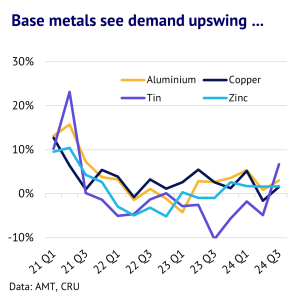

Fundamentals are being hampered by a patchy economy in China. Turning to the fundamental picture, China looks mixed, in terms of both end-use sectors and metal markets. Looking first at end-use markets, rapid growth is still taking place in strategically important sectors related to the green energy transition and electrical/electronic markets. For example, electric vehicle production grew by 35% y/y in the first eight months of this year, while solar PV saw 20% growth. This has boosted markets like copper and aluminium. CRU estimates that Chinese demand for these two grew by a decent 4.6% and 5.1% y/y in the first nine months of this year.

However, the construction market looks to be in terrible shape, consistent with sharp falls in housing starts and sales. The most recent figures for new house prices across seventy cities showed a 0.73% m/m fall – the biggest drop since 2014. End-use markets including cement, steel and asphalt are all suffering badly. Given this backdrop, it was no surprise to see that Chinese zinc demand growth has stagnated, given its reliance on construction and steel. CRU estimates 0.3% growth in the first 9 months of this year. However, even here the future looks brighter, as approvals for infrastructure spending soared in August and in the first half of September, according to consultancy firm PRC Macro.

World outside China being boosted by green energy transition and US rate cuts. For the world ex-China, the demand picture is steady. At first glance it is easy to find ammunition for bears. The global manufacturing PMI, for example, fell to 49.5 in August 2024, dragged down by weakness in Europe. However, metals are following a slightly different path, with CRU seeing a pick-up in growth rates for aluminium in H2 2024, in both Europe and the US. Furthermore, in Europe, the year ahead will see the launch of seven fully electric cars, priced at less than Euro25,000, potentially supporting aluminium and base metals more generally.

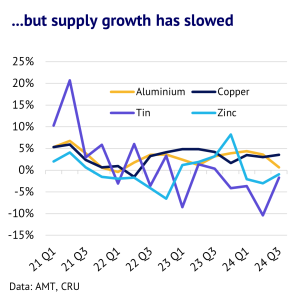

Base metal supply side looks very tight, with nickel a notable exception. Turning to supply side trends, significant tightness has emerged this year for aluminium, copper, tin and zinc, which helps justifies the run up in prices this year. Aluminium smelters are struggling with much higher spot alumina prices, with Australian quotes reaching US$545/t in mid-September, up 59% y/y. For copper and zinc, spot treatment charges have plummeted below zero this year, as mine supply has failed to keep pace with smelter demand. Lead is also struggling with scrap shortages in China. For tin, the main problems have been in Indonesia and Myanmar, where restrictions on mining have taken their toll. Most of the base metals have been hampered by a combination of a lack of investment, ironically due to the green energy transition, increased resource nationalism and rising inflation.

AMT algo model performance was 25% (annualised). In terms of our algo models, we have now been running these for just under five months using live data and the average return was 10.4% (performance to 24 September) or an annualised return of around 25% (excluding trading costs). The best performing models have been for aluminium, copper and zinc (annualised profit of 83%, 38% and 31%, respectively). The worst models were for lead and tin (annualised loss of 20% and 7%, respectively). The model for nickel is most likely distorted by the disorderly trading, which took place in 2022, and so we do not include it. Heading into LME Week the models are giving mixed signals, with a BUY for copper and tin, but a SELL for the other markets (updated on 24 September).

We expect base metal prices to mostly trend higher in the year ahead. In terms of our price forecast, we consider seasonality, the outlook for fundamentals and market sentiment and whether we believe that markets are correctly pricing in all these factors. We predict that three-month LME prices for aluminium, copper, tin and zinc will be higher by Q2 2025, compared to prices at the start of this week, with increases of 8%, 16%, 10% and 6%, respectively. On the other hand, we expect lead and nickel prices to fall, due to weak fundamentals.

Copper probably has the best fundamental outlook and speculators still have scope to build positions. Tin also looks strong from a fundamental perspective, but we are mindful that prices already include a lot of bullish news, after significant outperformance so far this year. Aluminium prices should also rally, based on raw material tightness and the capacity cap on smelters in China. Overall, we expect bullish sentiment to dominant in the base metals complex, helped by US interest rate cuts and increased stimulus measures in China.