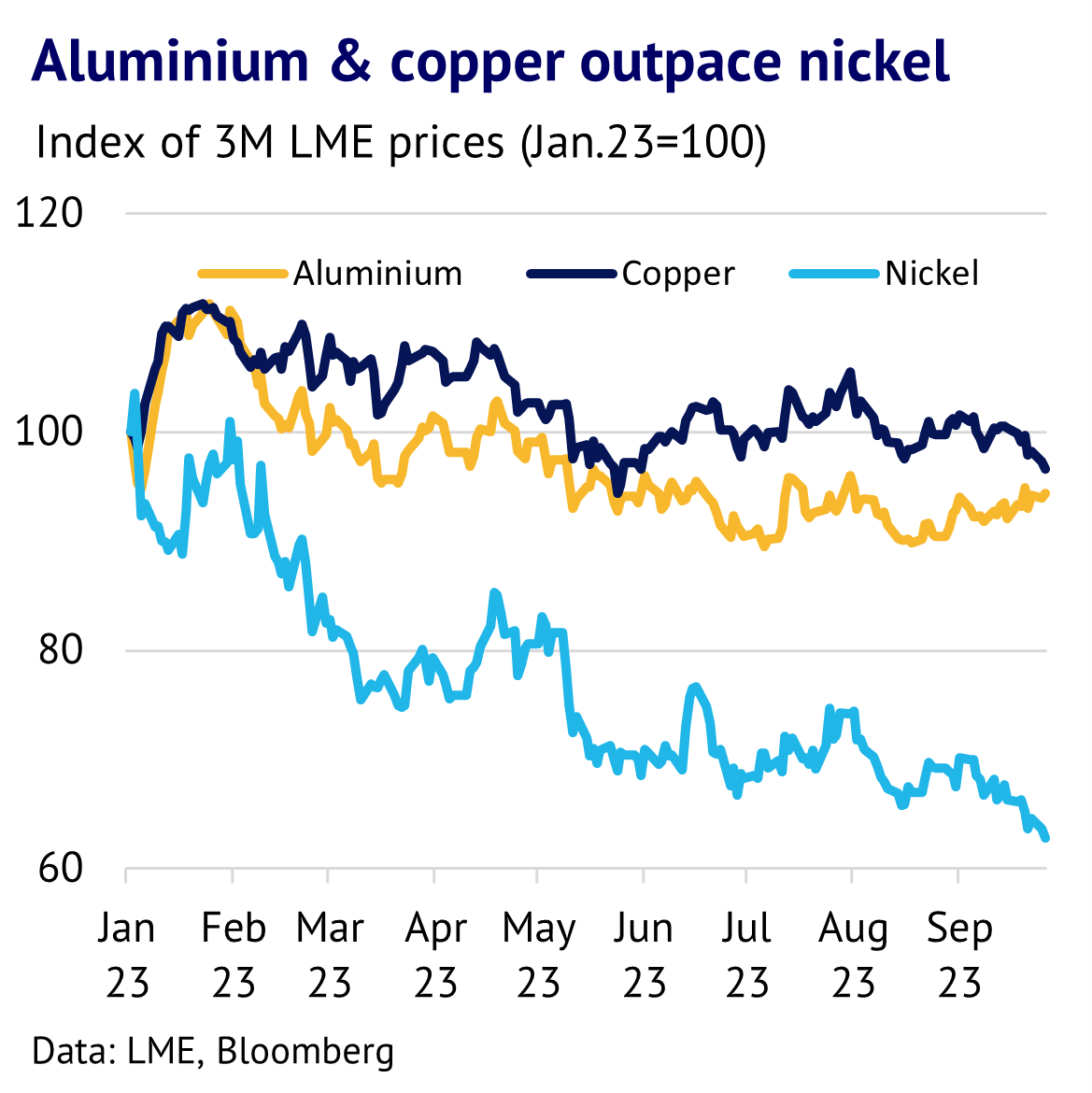

2nd October 2023: The major LME base metals have mostly rallied in the past year, although nickel and zinc prices have fallen sharply, reflecting poor fundamentals. One surprise has been the resilience of the base metals, despite the backdrop of problems in the Chinese property market. This is mainly because high debt levels at property developers have been isolated, with limited feedback into the rest of the economy. Furthermore, government boosts to green-energy-related sectors were very significant. However, in the year ahead, we expect bearish drivers to dominate, as weak activity in the OECD countries overpowers more positive drivers coming from China and the green transition. We expect aluminium and tin prices to outperform, while copper, lead, nickel and zinc prices are expected to fall.

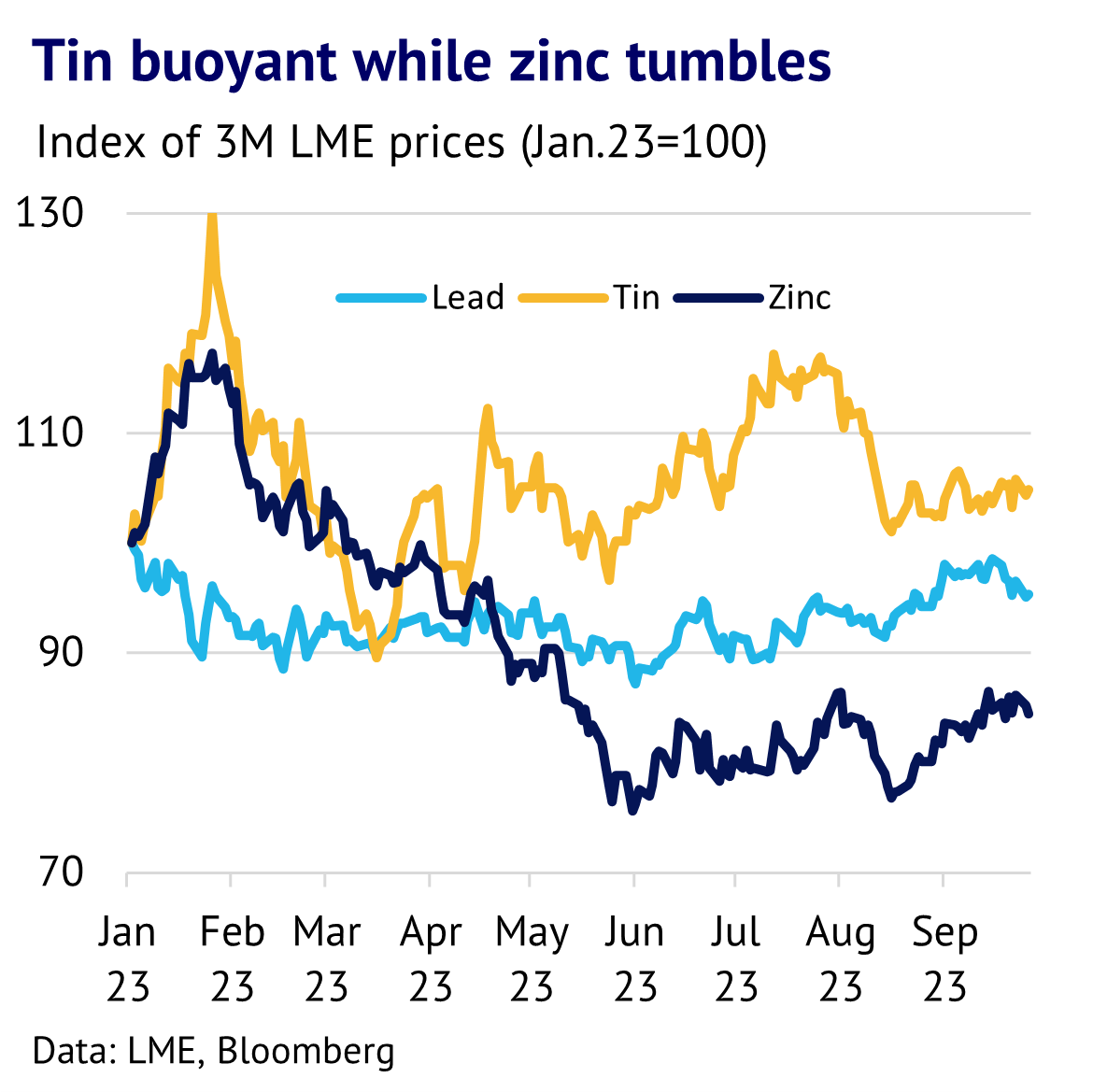

LME metals find their own path, as fundamental drivers reassert themselves. In the past year, the major LME metals have seen significant divergence, reflecting fundamentals, but also a tendency for speculators to be selective. Lead and tin have significantly outperformed (up 14% y/y and 17% y/y respectively by 2nd October), while aluminium and copper have both rallied by 8%. On the other hand, nickel and zinc have both fallen by 11% y/y. Financial markets have generally been supportive, with the MSCI global equity index up 19% y/y, while the USD has fallen by 5%, so the general uptrend in base metals was consistent with a broader improvement in risk appetite.

Russian exports were resilient, as shipments get diverted. When we wrote our previous LME Week outlook piece, back in October 2022, the threat of a Russian export ban was keeping markets on edge. It can be found here: Base metals: reasons to be cheerful and fearful. We highlighted tight market balances for copper, lead, tin and zinc, but weak fundamentals for aluminium and nickel. Price trends in the past year have been broadly consistent with this, although we misjudged the outlook for zinc, as it was weaker than expected, due to a demand slump in Europe.

Overall, the base metals complex has not been as tight as we anticipated a year ago, partly due to resilience on the supply side of the industry. Russian output has been higher than anticipated, despite Western sanctions, with a lot of shipments being redirected to places like China. CRU figures for Q2 showed little change in Russian production for aluminium and zinc, for example and implied net exports for aluminium have not changed much in the past year, despite fears of a sharp fall. Meanwhile, copper and nickel saw only modest falls in Russian production, with cuts of 3% and 9% respectively.

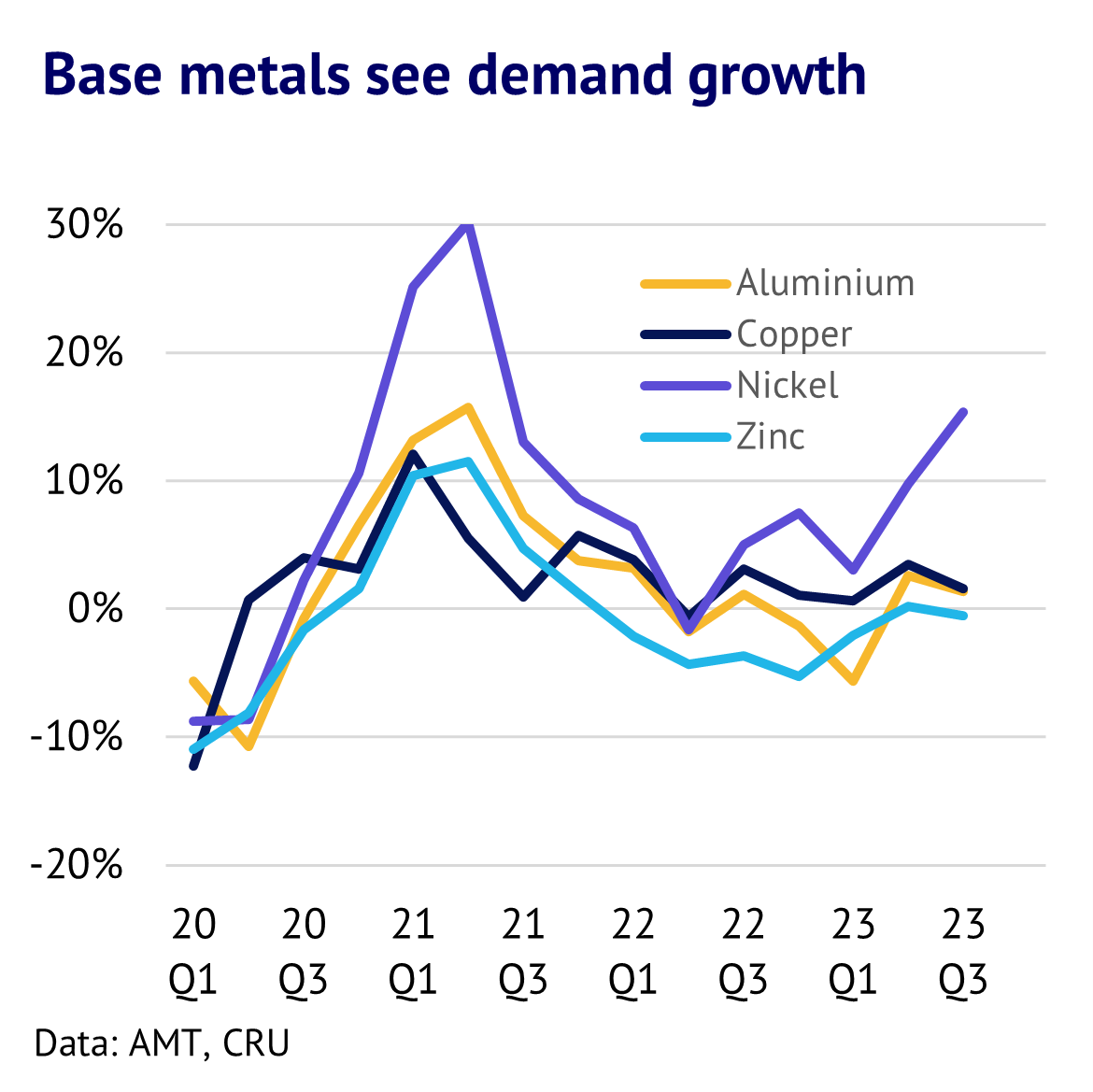

Base metal demand feels the power of green energy transition. While there were a lot of headlines in recent months about a slowing world economy, the base metals followed their own path, helped by solid growth in sectors related to the green energy transition – electric vehicles (EVs), solar and wind power generation and related investment in the power grid. Headwinds came from problems in the global construction/property markets, but these were not significant enough to offset other factors.

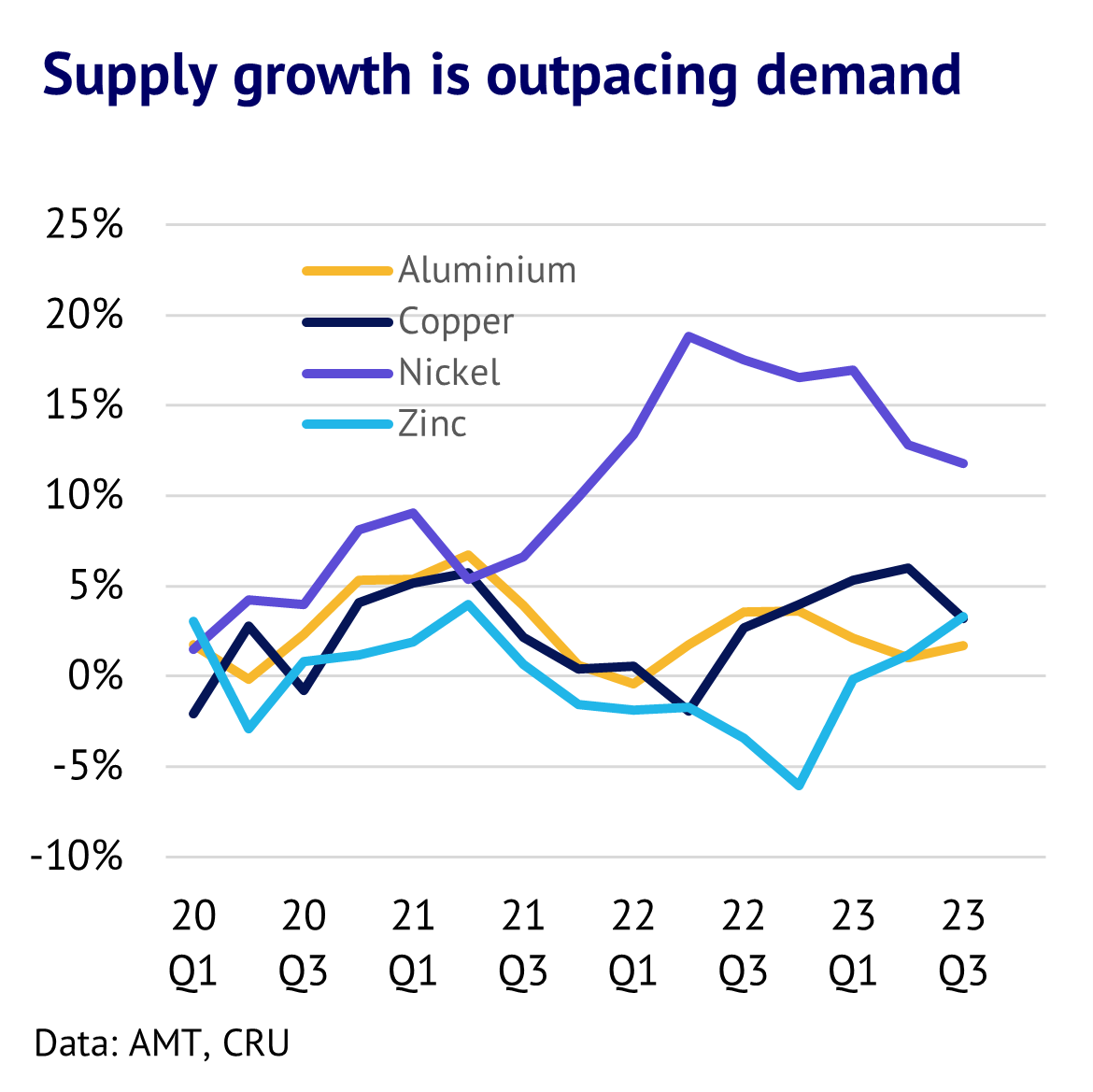

We show in our next chart that base metals demand growth slowed steadily from Q1 2021, but then found a floor in late 2022 and early 2023. Nickel led the most recent upswing, with copper maintaining steady growth and aluminium returning to growth by Q3 2023. Even zinc stabilised in Q3, after a period of weakness in early 2023.

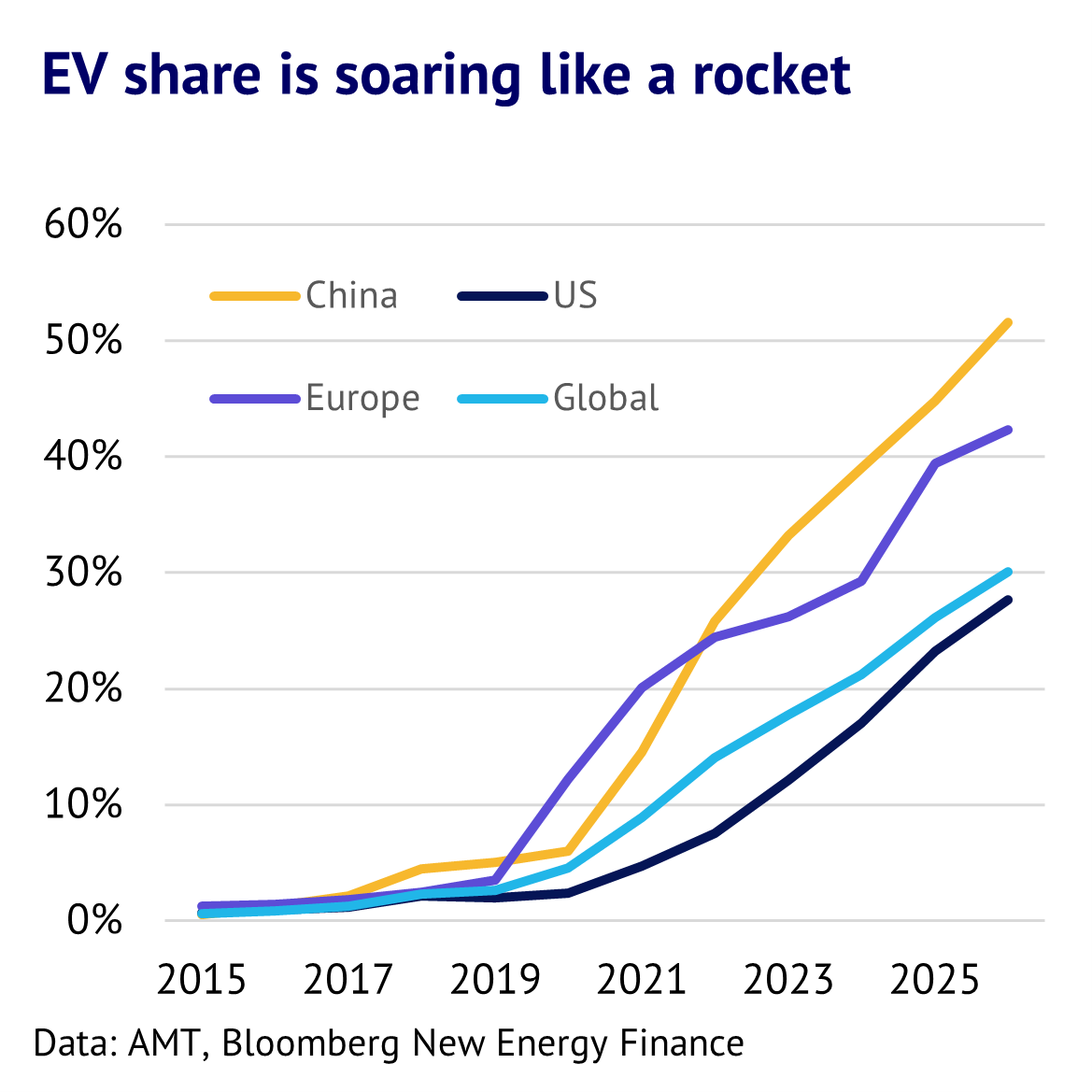

The green energy boom can be seen most clearly in the EV sector. Bloomberg New Energy Finance (BNEF) is forecasting global EV sales growth of 34% this year and 25% growth in 2024. The US is expected to be the fastest growing major country, with a 73% jump this year, followed by 46% growth in 2024. Copper and nickel are both seeing a significant boost from this boom, although the amount of copper per vehicle is now falling (from 80kg per car to around 50kg), while lithium batteries with a high-nickel content are losing market share to cheaper lithium-iron-phosphate (LFP) batteries, which contain no nickel. Copper demand is currently growing more quickly than aluminium demand, which is a rare occurrence.

Many countries are also pumping money into their power grids, as the boom in EVs can only continue with a rapid expansion in electric charging points – boosting demand for both aluminium and copper. In China, for example, the National Energy Administration (NEA) reported grid investment at RMB247.3 bn in the first seven months of the year, up 10.4% y/y.

Base metals supply is ramping up, helping to drive markets into oversupply. While nickel has led the way higher in terms of demand growth, supply growth has been even faster, pushing the market into oversupply. Global production rose by a robust 12% y/y in Q3, boosted by a rapid expansion in Indonesia. CRU are estimating a global oversupply of 191kt in the period Q1-Q3 2023, with a lot of inventory accumulating outside the official reporting system in Class 2 nickel (nickel pig iron and ferronickel).

Global production growth for copper was also significant, with a 3% y/y increase in Q3. In this case, China has been the key driver, with a jump in imported copper concentrate from places like the DRC, coinciding with new domestic smelter capacity. As a result, the copper market has also swung into an oversupply of 386kt in Q1-Q3 2023, according to CRU figures. Again, this points to an off-exchange inventory build in the first half of this year, which could weigh on future prices.

For zinc, global production also grew rapidly, with a 3% y/y increase in Q3. CRU estimates that the global zinc market was in a surplus of 129kt in the period Q1-Q3 2023. While some significant zinc mines have closed recently in Europe, this could be offset by growth in places like Peru and Russia. In the next few years, the concentrate market is heavily dependent on growth from the giant Ozernoye mine in Russia, which could eventually reach 600kt/y of contained zinc. Without this, smelters could struggle to secure enough concentrate, even if demand grows modestly.

For aluminium, production growth has slowed recently, as power problems in China have taken their toll and the country has been importing more metal. We discuss this in more detail in our research piece: Aluminium: China springs a surprise. Global supply growth was just 1.7% y/y in Q3 – the weakest growth among the major base metals. However, the market was still estimated to be in a 567kt surplus in Q1-Q3 2023.

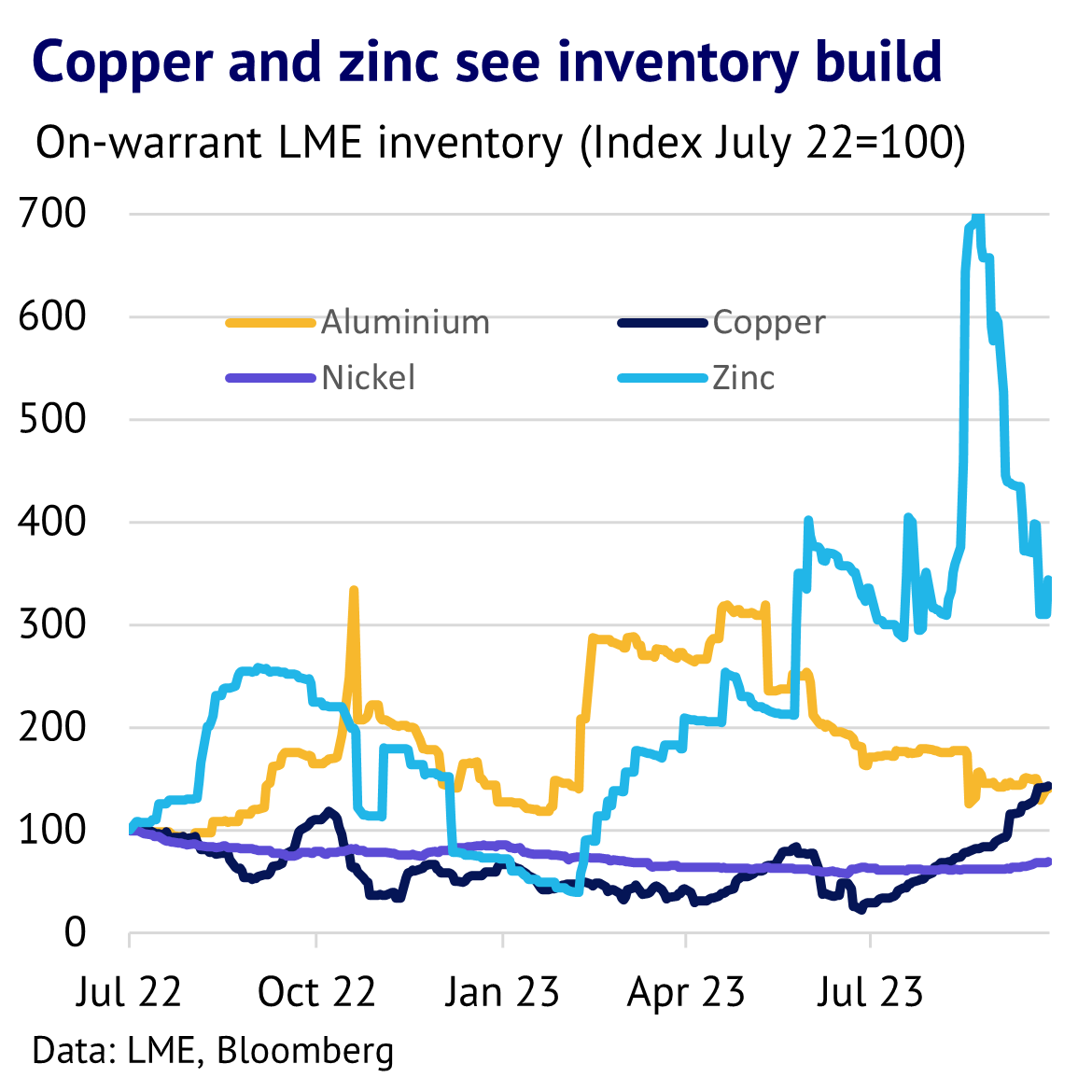

Exchange inventories have been building, but are still low. In terms of the trend in exchange inventories (LME and SHFE), these should in theory reflect any market surpluses or deficits discussed above, although changes in inventory levels outside the official reporting system are notoriously difficult to track. Nevertheless, there were significant increases seen in most of the complex in the past year. These were consistent with markets being in surplus, but there was still a large gap between implied surpluses (large) and exchange inventory builds (small).

For example, exchange inventory for tin was up 53% y/y by 2nd October, while copper was up 17%. Aluminium and zinc were up 4% and 19% y/y respectively, although in both cases cancelled warrant levels are high, so these increases might be reversed soon. Nickel inventories were down 12% y/y, mainly because oversupply is concentrated in Class 2 nickel, which is not deliverable to the LME. Despite these trends, inventory levels for aluminium, copper, lead and zinc remain very low, at around 3-4 days of global consumption. Nickel and tin inventories are more comfortable, at 6 and 14 days, respectively.

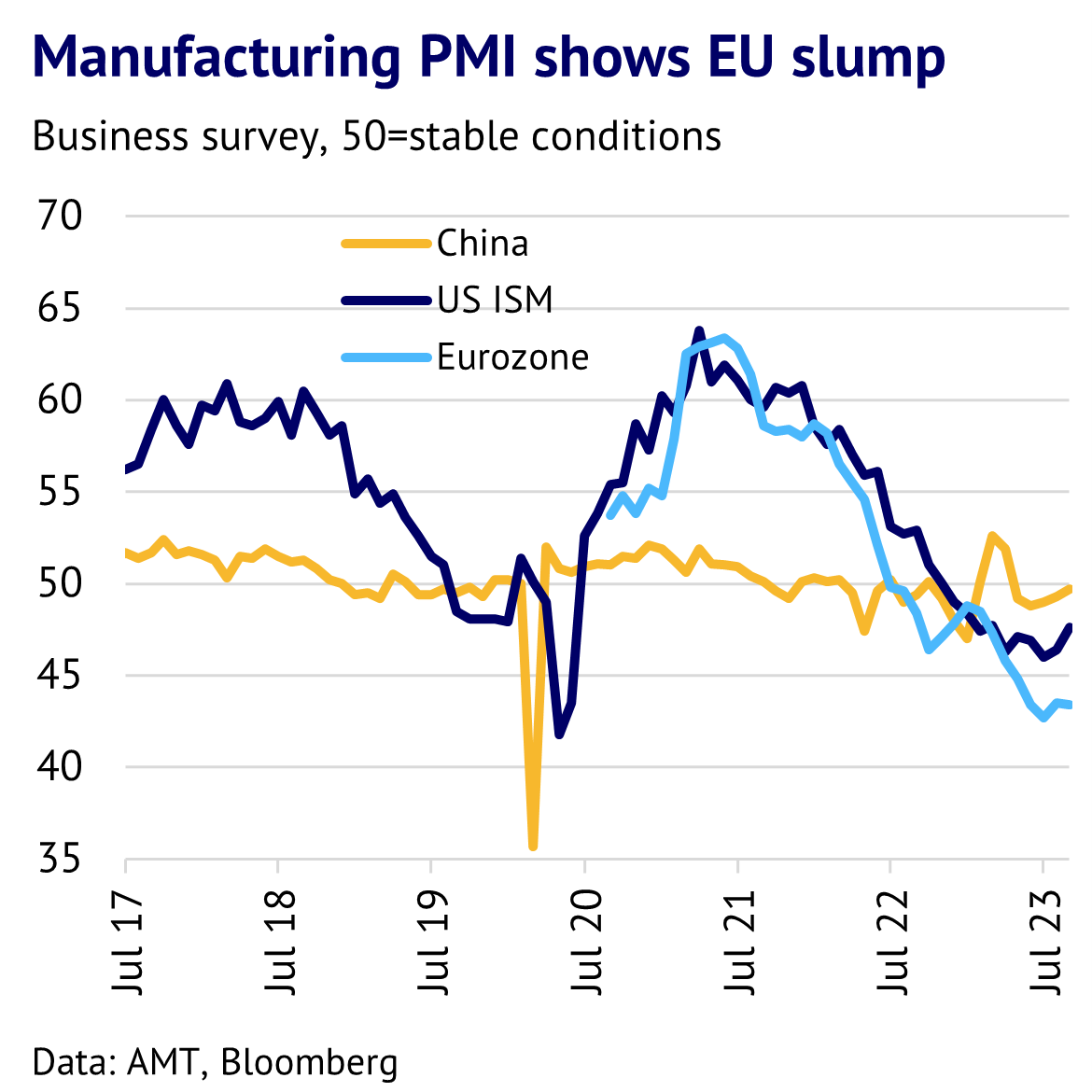

Risks on the horizon include China property slump and delayed impact from OECD interest rate increases. In terms of the outlook, the base metal markets are facing significant headwinds from slowing growth in the OECD area, which we believe will overpower bullish drivers coming from China. Europe is an area of particular concern for bulls, with manufacturing PMIs showing recessionary conditions in September, as we show in our chart. The recent jump in oil prices also threatens to restoke inflationary pressures in the region (Brent oil is currently up to US$93/bbl). The US looks more resilient at this point, but even here the backlog of rate hikes is likely to create significant headwinds for late 2023 and early 2024. Markets are assuming a very low chance of a US recession, despite this, which seems complacent.

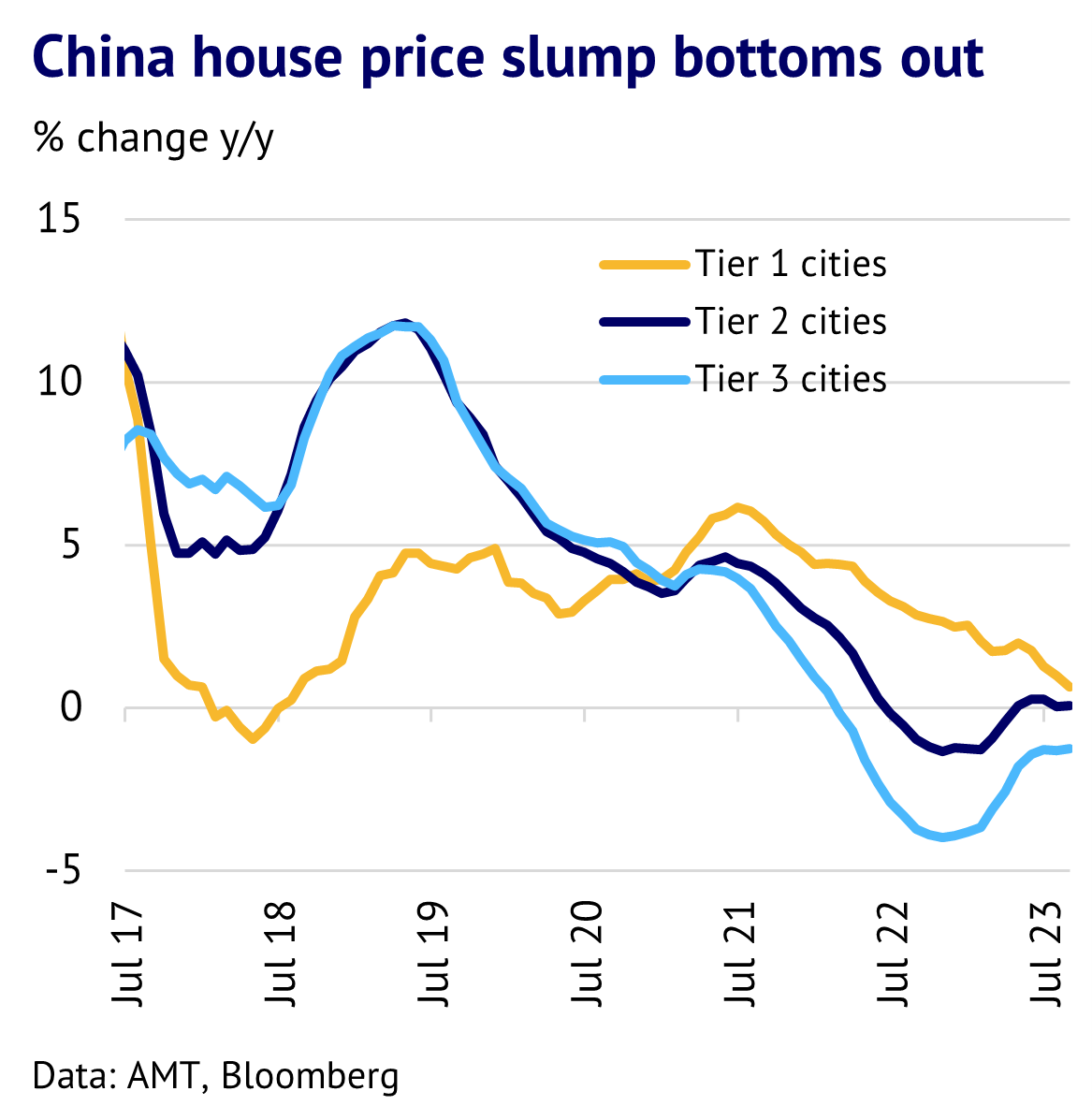

By contrast, in terms of China, market sentiment looks too bearish to us. While there are significant ongoing problems in the property market, house prices have started to stabilise as we show in our chart above. Bloomberg economists estimate that the recent package of small stimulus measures for the economy will add up to a significant 1.8% boost to GDP for 2024. Besides the government focus on completing existing properties will encourage consumers to spend money on air conditioning and appliances for new houses, all of which will help to lift demand for many of the base metals.

Base metal prices to trend lower, but we expect aluminium and tin to outperform. In summary, the past year has been a bullish period for most of the base metals, although significant price divergence has been seen. A year ago, many expected Russian supply to be a key driver for prices, but the green energy transition has been more important, lifting demand for copper and nickel, in particular. Helped by this, copper demand is outpacing aluminium, which is an unusual occurrence.

Aluminium has also seen demand lifted by the green boom, although limited power availability in China remains a more important driver for the time being. Lead and tin have outperformed their base metal peers. Looking ahead though we expect the two markets to diverge, with tin benefiting from improved demand, while lead should see speculative interest fading as the year progresses. Overall, the base metals complex should trend lower in the year ahead, with individual fundamentals playing a key role once more.